Override the tax in D365 FinOps

Today, I am going to share some activities based on Sales tax on to "Override" and "Remove the adjusted tax amount" too for a particular Sales order.

Task# 01: To override sales tax amount in a Sales order

Here, I am going to share my experience to override the sales tax (adjust sales tax) in a Sales order.

Scenario# 1.1: To override sales tax in a sales order

Here, you just need SalesTable buffer at runtime which you need to pass to the code. I have a custom field control in the SalesTable where I am storing total actual tax amount (which I am getting from the third-party tool).

TaxRegulation taxRegulation;

SalesTotals salesTotals = SalesTotals::construct(salesTableLocal);

salesTotals.calc();

taxRegulation = TaxRegulation::newTaxRegulation(salesTotals.tax());

taxRegulation.allocateAmount(salesTableLocal.HSTotalWebTaxAmountCur);

taxRegulation.saveTaxRegulation();

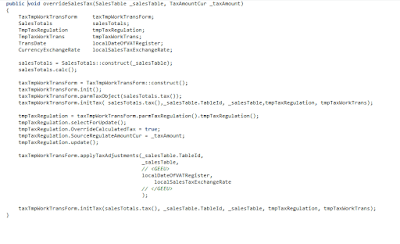

Scenario# 1.2: To override sales tax in a sales order

Here, the scenario is to create a Sales order and post Sales invoice along with Tax override activity too.

Task# 02: To reset Actual to Calculated sales tax amount in a Sales order

Here, I am going to share my experience on to remove adjusted sales tax amount in a Sales order.

Scenario# 2.1: To override sales tax in a sales order

Here, you just need SalesTable buffer at runtime which you need to pass to the code.

// reset actual to calculated sales tax amount.

TaxRegulation taxRegulation;

SalesTotals salesTotals = SalesTotals::construct(salesTableLocal);

salesTotals.calc();

taxRegulation = TaxRegulation::newTaxRegulation(salesTotals.tax(), null,salesTableLocal.TableId, salesTableLocal.RecId);

if (taxRegulation.taxLinesExist())

{

taxRegulation.resetTaxRegulation();

taxRegulation.saveTaxRegulation();

}

Happy DAXing...

No comments:

Post a Comment