How to calculate total tax for a Sales order using X++

Today, I will show, how to calculate tax in D365 FO (AX) through code

Scenario 1: To find Sales Totals values for Sales order in D365

Here, my requirement is to export Sales Totals component's value through custom data entity. I have applied below logic, hope it will help you...

Accounts receivable/ All sales orders/ select any Sales order/ Sales order button group/ View/ Totals public void postLoad()

{

SalesLine salesLineLoc;

SalesTable salesTableLoc = SalesTable::find(this.SalesId);

SalesTotals totals;

super();

select sum(LineAmount) from salesLineLoc

where salesLineLoc.SalesId == salesTableLoc.SalesId;

this.SubTotalAmount = salesLineLoc.LineAmount;

// No problem if the total is not negative

totals = SalesTotals::construct(salesTableLoc, SalesUpdate::All);

totals.calc();

this.TotalEndDisc = conPeek(totals.displayFields(), TradeTotals::posEndDisc());

this.TotalLineDisc = conPeek(totals.displayFields(), TradeTotals::posLineDisc());

this.TotalCharges = conPeek(totals.displayFields(), TradeTotals::posMarkup());

this.InvoiceAmount = conPeek(totals.displayFields(), TradeTotals::posTotalAmount());

salesLineLoc = null;

salesLineLoc = SalesLine::findInventTransId(this.InventTransId);

if (salesTableLoc.HSChangedInD365 == NoYes::No)

{

this.WebShippingTaxAmount = salesTableLoc.HSWebChargeTaxAmountCur;

this.TotalTaxAmount = salesTableLoc.HSTotalWebTaxAmountCur;

this.LineTaxAmount = salesLineLoc.HSWebLineTaxAmountCur;

}

else

{

this.TotalTaxAmount = conPeek(totals.displayFields(), TradeTotals::posTaxTotal());

//this.TotalTaxAmount = abs(salesTotals.tax().totalTaxAmountCalculated()); // Total calculated sales tax amount

//this.TotalTaxAmount = abs(salesTotals.tax().totalTaxAmount()); // Total actual sales tax amount

totals.tax().sourceSingleLine(true, true);

this.LineTaxAmount = totals.tax().totalRegulatedTaxAmountSingleLine(salesLineLoc.TableId, salesLineLoc.RecId); // sales line actual tax amount

//this.LineTaxAmount = salesTotals.tax().totalTaxAmountSingleLine(salesLineLoc.TableId, salesLineLoc.RecId); // sales line calculated tax amount

// to get calculated tax for a particular charge line associated with a sales order.

MarkupTrans markupTransLoc;

select firstonly markupTransLoc

where markupTransLoc.MarkupCode == HSIntegrationParameters::find().PaidByCustomer //'CUSTFRGHT'

&& markupTransLoc.TransRecId == salesTableLoc.RecId

&& markupTransLoc.TransTableId == tableNum(SalesTable);

this.WebShippingTaxAmount = abs(totals.tax().taxPrLine(tableNum(MarkupTrans), markupTransLoc.RecId));

}

}

//You have to pass these values to the functions whether it comes from PurchLine or SalesLine or any other table.

//This may not work for Avalara tax engine then follow below scenarios...

Tax::calcTaxAmount(purchLine.TaxGroup, purchLine.TaxItemGroup, Systemdateget(), purchLine.CurrencyCode, purchLine.LineAmount, TaxModuleType::Purch);

Scenario 2.1: To calculate tax for each Sales order line in D365

I have written display method in SalesLine table to show line-wise calculated sales tax. This method can be utilized in multiple places...

public display TaxAmountCur displayLineTaxAmount()

{

salesTable salesTable;

SalesTotals salesTotals;

TaxAmountCur taxAmountCur;

salesTable = SalesTable::find(this.SalesId, false);

salesTotals = SalesTotals::construct(salesTable, SalesUpdate::All);

salesTotals.calc();

salesTotals.tax().sourceSingleLine(true, true);

taxAmountCur = salesTotals.tax().totalTaxAmountSingleLine(this.TableId, this.RecId);

return TaxAmountCur;

}

Scenario 2.2: To calculate tax for each Sales order line in D365

I have written display method in SalesLine table to show line-wise calculated sales tax. This method can be utilized in multiple places...

public display TaxAmount displayLineTaxAmount()

{

SalesLine salesLineLoc;

select firstonly salesLineLoc

where salesLineLoc.RecId == this.RecId;

return Tax::calcTaxAmount(salesLineLoc.TaxGroup,

salesLineLoc.TaxItemGroup,

Systemdateget(),

salesLineLoc.CurrencyCode,

salesLineLoc.LineAmount,

TaxModuleType::Sales);

}

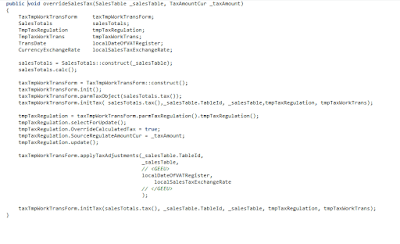

Scenario 3: To calculate tax for Sales order in D365

I have written display method in SalesTable table to show total calculated sales tax. This method can be utilized in multiple places...

public display TaxAmountCur displayTotalTaxAmount()

{

salesTable salesTable;

SalesTotals salesTotals;

TaxAmountCur taxAmountCur;

salesTable = SalesTable::find(this.SalesId, false);

salesTotals = SalesTotals::construct(salesTable, SalesUpdate::All);

salesTotals.calc();

taxAmountCur = abs(salesTotals.tax().totalTaxAmount());

return TaxAmountCur;

}

Add display method as a data field in Field groups in a table

ScenariScenario 4: To calculate tax for each Purchase order line in D365.

I have written display method in PurchLine table to show line-wise calculated purch tax. This method can be utilized in multiple places...

public display TaxAmountCur totalTaxAmount(boolean _adjustTaxSign = true, boolean _includeUseTax = false)

{

PurchTotals purchTotals;

TaxAmountCur taxAmountCur;

purchTotals = PurchTotals::newPurchTable(this.purchTable());

purchTotals.calc();

purchTotals.tax().sourceSingleLine(true, true);

taxAmountCur = purchTotals.tax().totalTaxAmountSingleLine(this.TableId, this.RecId, _adjustTaxSign, _includeUseTax);

return taxAmountCur;

}

Scenario 5: To calculate tax for Purchase order in D365

I have written display method in PurchTable table to show total calculated purch tax. This method can be utilized in multiple places...

public display TaxAmountCur totalTaxAmount(boolean _adjustTaxSign = true, boolean _includeUseTax = false)

{

PurchTotals purchTotals;

TaxAmountCur taxAmountCur;

purchTotals = PurchTotals::newPurchTable(this.purchTable());

purchTotals.calc();

taxAmountCur = purchTotals.tax().totalTaxAmount();

return taxAmountCur;

}

Scenario 6: To calculate tax for GL journal in D365

I have written display method in LedgerJournalTrans table to show total calculated tax. This method can be utilized in multiple places...

public display TaxAmountCur totalTaxAmount(boolean _adjustTaxSign = true, boolean _includeUseTax = false)

{

TaxCalculation taxCalculation;

LedgerJournalTrans ledgerJournalTrans;

TmpTaxWorkTrans tmpTaxWorkTrans;

TaxAmountCur taxAmountCur;

ledgerJournalTrans = LedgerJournalTrans::findRecId(5637293082, false);

// This is from `\Classes\LedgerJournalEngine\getShowTax`

taxCalculation = LedgerJournalTrans::getTaxInstance(ledgerJournalTrans.JournalNum,

ledgerJournalTrans.Voucher,

ledgerJournalTrans.Invoice,

true,

null,

false,

ledgerJournalTrans.TransDate);

taxCalculation.sourceSingleLine(true, false);

// This is from `\Classes\TaxTmpWorkTransForm\initTax`

tmpTaxWorkTrans.setTmpData(taxCalculation.tmpTaxWorkTrans());

// This is the temporary table that is populated

while select tmpTaxWorkTrans

{

// This is from `\Classes\TaxTmpWorkTransForm\getSourceBaseAmountCur`

taxAmountCur = (tmpTaxWorkTrans.SourceTaxAmountCur * tmpTaxWorkTrans.taxChangeDisplaySign(null));

// This just outputs some data

info(strFmt("%1: %2", tmpTaxWorkTrans.TaxCode, taxAmountCur));

}

return taxAmountCur;

}

--------------------------------

Happy DAXing...